does cash app report to irs for personal use

Does Cash App Report Personal Accounts To Irs. Starting this year.

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Cash App wont report any of your personal transactions to the IRS.

. Whos covered For purposes of cash payments a person is defined as an individual company corporation partnership association trust or estate. For example if you purchased a dress for 100 and sold it for 50 the amount is not taxable. Also if you receive money from selling a personal item at a loss you are not required to report the amount on your tax return.

Small companies farmers market sellers and hair stylists to mention a few can collect payments with a cash app in a more contemporary manner than. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. KERO The IRS has designed new ways of taxing cash app transactions but misconceptions might be leaving some confused about who these changes apply to.

You must be aware of the IRS requirements for reporting cash app income as a merchant or a person. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions.

Only customers with a Cash for. Does The Cash App Report To Irs. Millions of businesses accept electronic payments for their services but the IRS is.

Herein does Cashapp report to IRS. Instead the reporting requirements for digital payment apps such as Venmo and PayPal have changed. The only difference you might see in 2023 is a 1099-K in your mailbox if you received.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. According to the Cash App website certain accounts receive 1099 tax forms. Many small enterprises have embraced the usage of digital payment channels in recent years.

For this reason it is recommended that you set up separate cash apps for business and personal use. Make sure you fill that form out correctly and submit it on time. So if you use PayPal Venmo Cash App or any other third-party payment service to receive payments for your business they will generate and deliver a Form 1099-K for all.

According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. The Composite Form 1099 will list any gains or losses from those shares. Form 1099-B is the general form you fill out if youve been making money on.

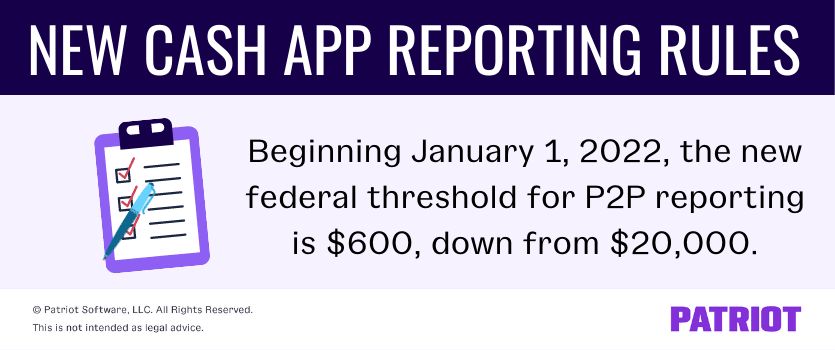

Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. The answer is very simple. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain payment transactions that.

What Does Cash App Report to the IRS. If you have a standard non-business Cash App account you dont need to worry about Form 1099-K. Form 1099-K is used to report transactions for the sale of goods andor services through peer-to-peer P2P payment services like Cash App.

The new cash app regulation isnt a new tax. The new rule which took effect. However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year.

Cash App Won T Have New Taxes In 2022 Despite Claims

Federal Government To Ask For Taxes On App Transactions Over 600

Irs Has New Ways Of Taxing Cash App Transactions

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Changes To Cash App Reporting Threshold Paypal Venmo More

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

How To Easily File Your Cash App 1099 Taxes Step By Step

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Get Ready To Pay Taxes On Money Earned Through Paypal And Venmo Next Year Cnet

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules