trust capital gains tax rate 2021

For tax year 2022 the 20 rate applies to amounts above 13700. For tax year 2022 the 20 rate applies to amounts above 13700.

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Find out more about Capital Gains Tax and trusts.

. Below is a summary of the 2021 figures. The tax-free allowance for. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Weve got all the 2021 and 2022 capital gains.

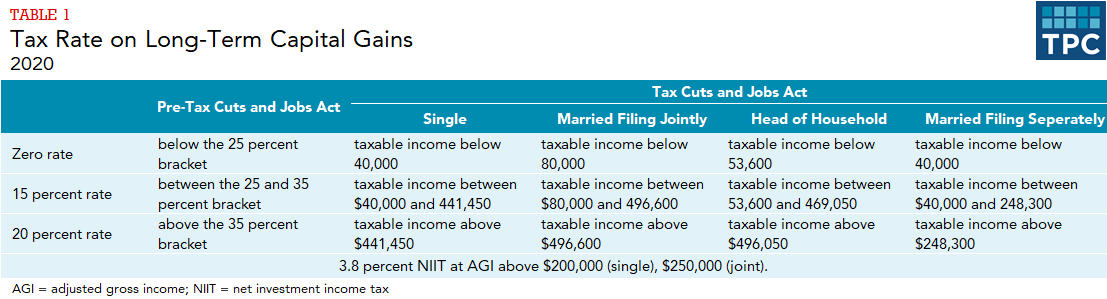

For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250. Irrevocable trusts are very different from revocable trusts in the way they are taxed. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

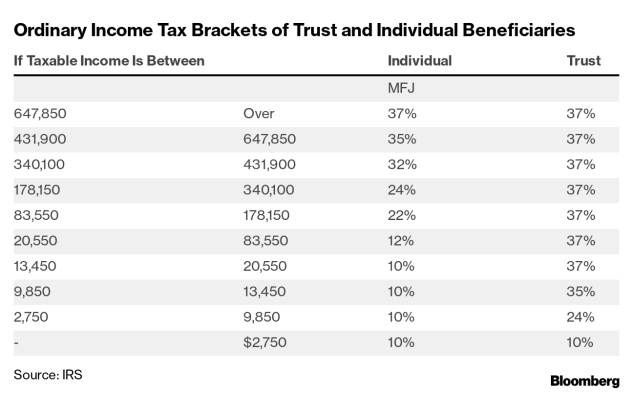

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Work out your tax - GOVUK 2 weeks ago Apr 05 2022 Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

Events that trigger a disposal include a sale donation exchange loss death and emigration. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. It continues to be important to obtain date of. Trusts and Capital Gains.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. First deduct the Capital Gains tax-free allowance from your taxable gain. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

2021 Long-Term Capital Gains Trust Tax Rates. What is the 2021 capital gain rate. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The maximum tax rate for long-term capital gains and qualified dividends is 20. The 0 and 15 rates continue to apply. 2022 Long-Term Capital Gains Trust Tax Rates.

The 0 and 15 rates. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. The following Capital Gains Tax rates apply.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. 2020 to 2021 2019 to 2020 2018 to 2019. The 0 and 15 rates continue to apply.

It continues to be important to obtain date of. They would apply to the tax return. Capital gains and qualified dividends.

Add this to your taxable. The original news release from the IRS may be found here. 2021 Gift GST and Trusts Estates Income Tax Rates.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as. 2021 Long-Term Capital Gains Trust Tax Rates 0. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing.

The following are some of the specific exclusions. However it was struck down in March 2022.

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

State Unemployment Trust Funds 2021 Unemployment Compensation

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

How Are Dividends Taxed Overview 2021 Tax Rates Examples

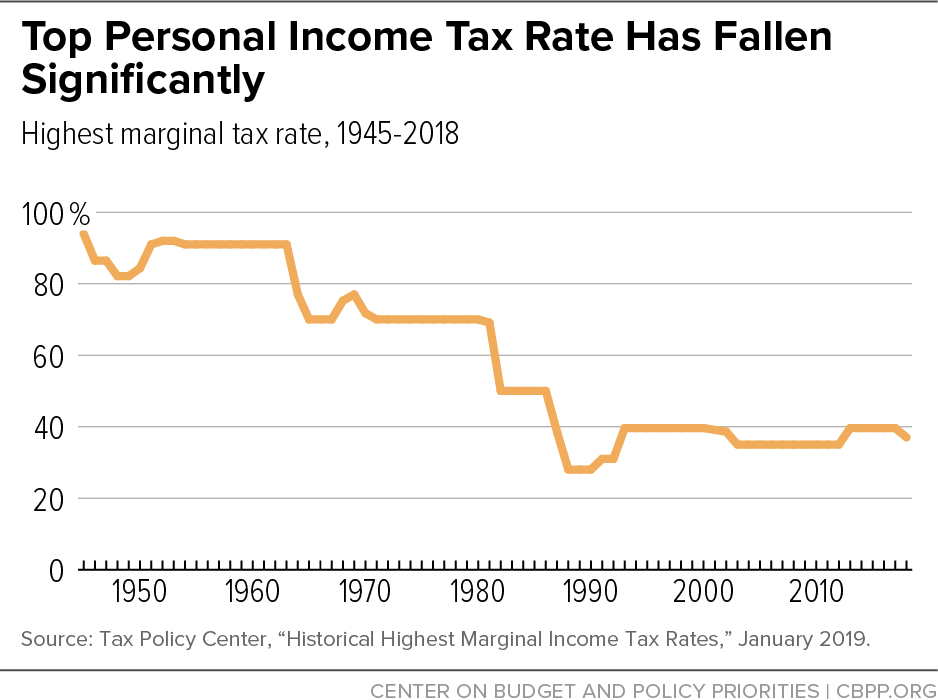

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Navigating Family Trusts And Taxes Turbotax Tax Tips Videos

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Tax Advantages For Donor Advised Funds Nptrust

New Tax Initiatives Could Be Unveiled Commerce Trust Company

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger