operating cash flow ratio adalah

Apa itu Laporan Cash Flow. Ada beberapa cara untuk menghitung rasio arus kas.

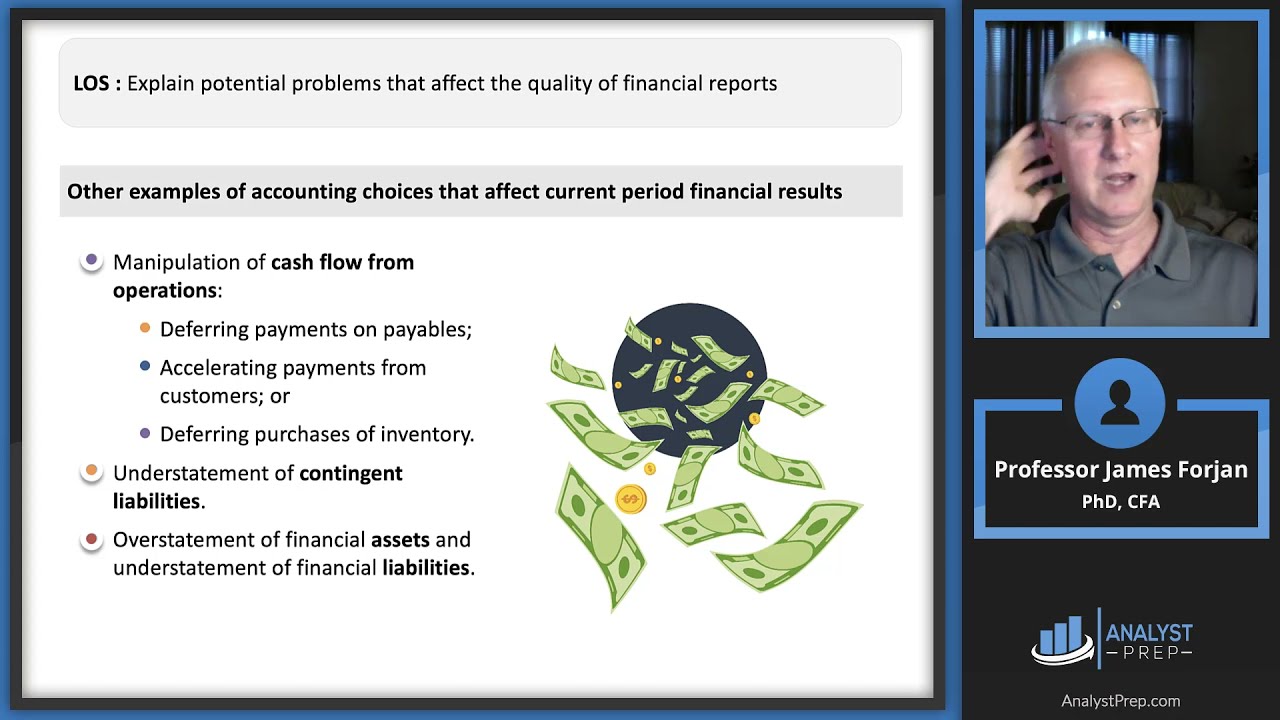

Indicators Of Cash Flow Quality Cfa Frm And Actuarial Exams Study Notes

Arus kas dari operasi kewajiban operating cash flow ratio.

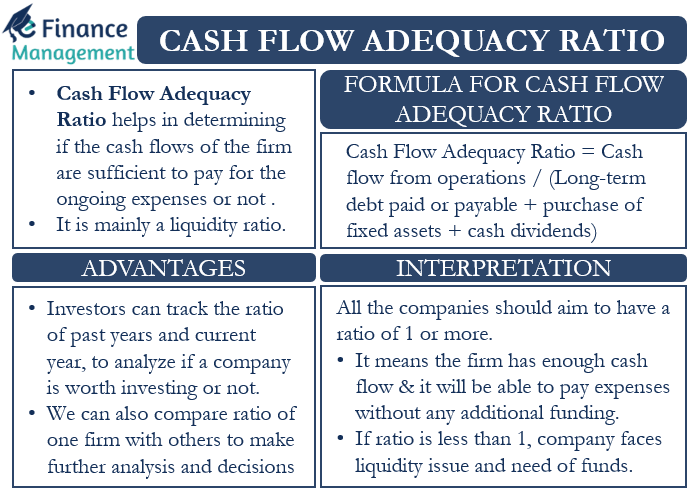

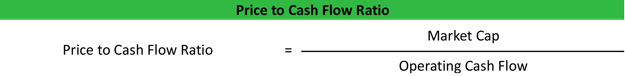

. The formula to calculate the ratio is as follows. Definisi Arus Kas dari Operasi Cash Flow from Operating Acivities. This ratio is a type of coverage ratio and can be.

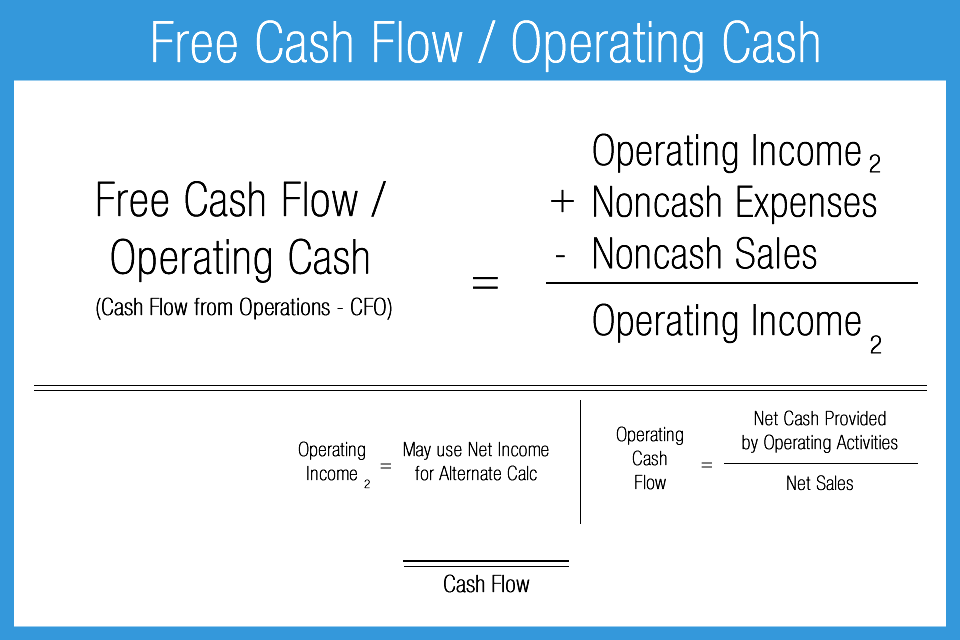

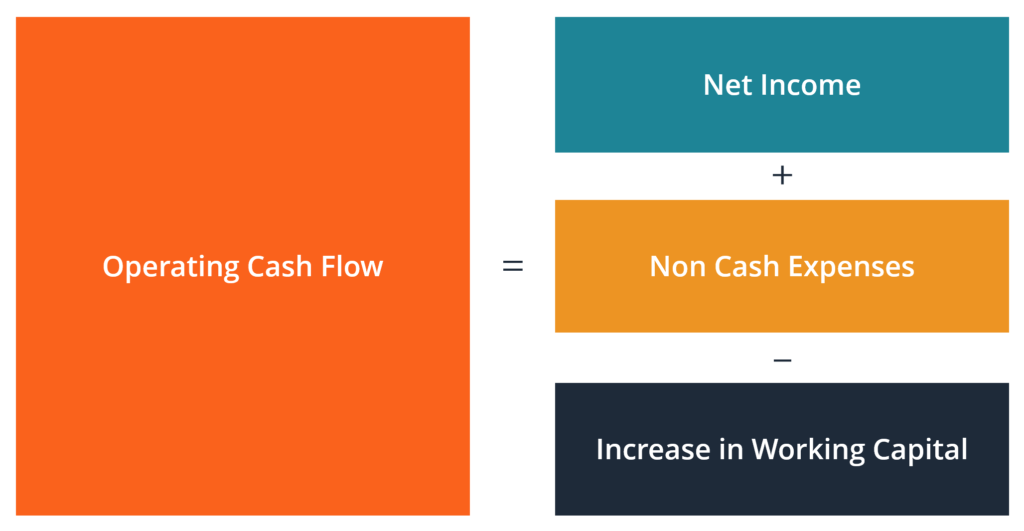

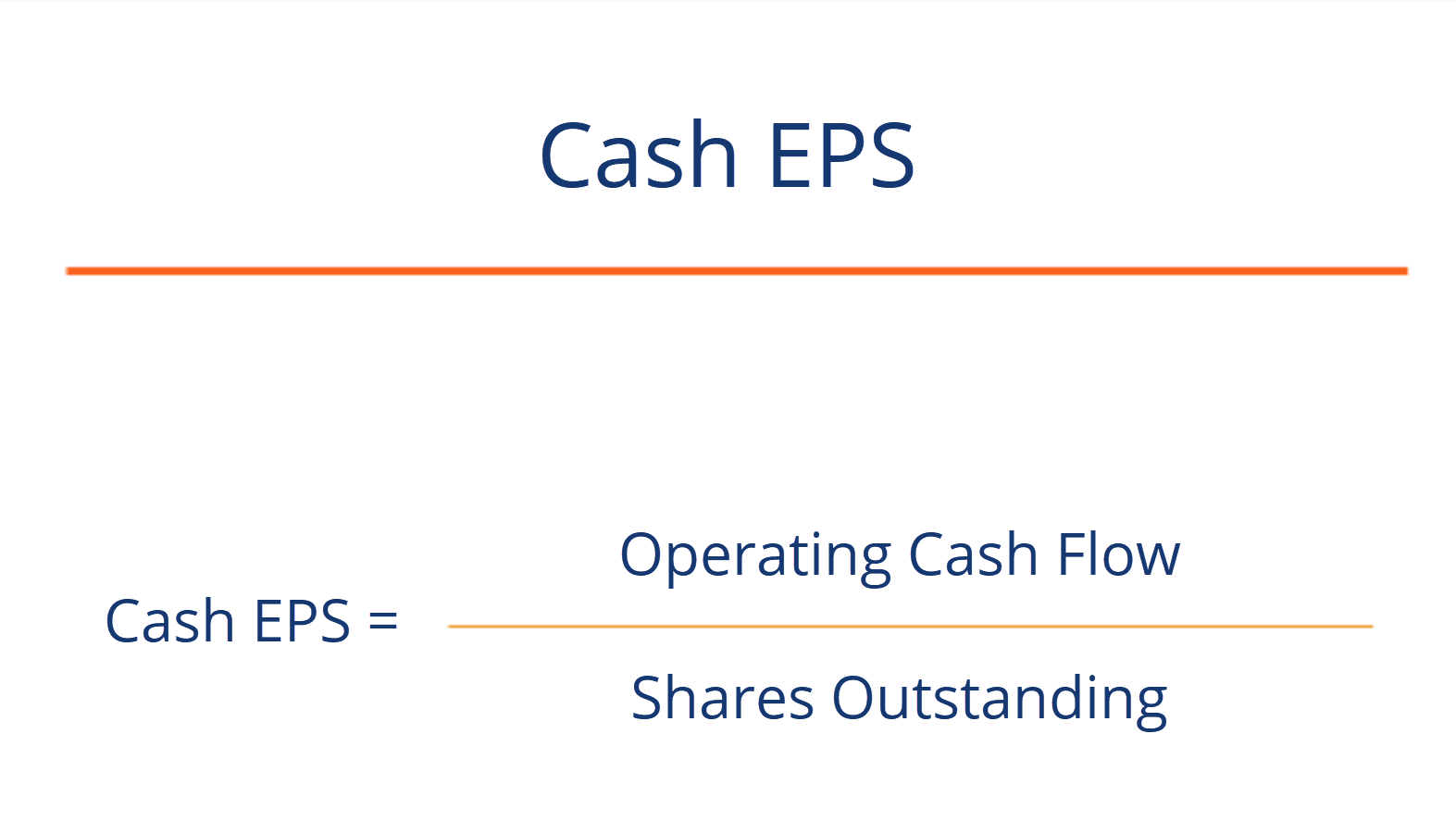

Laporan arus kas adalah komponen dari laporan keuangan yang memuat informasi mengenai aliran keluar masuknya kas dan setara kas. Operating Cash Flow Ratio Definition Jadi Cash Flow per Share Rp 588 atau jika disetahunkan menjadi 58824 Rp 118. When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a.

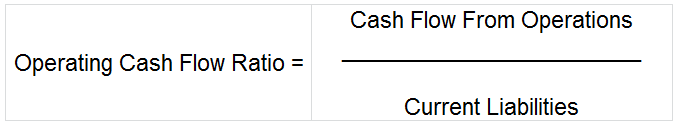

872 975. The operating cash flow ratio is a measurement that indicates whether the cash created from continuing operations is sufficient to pay for the current obligations your. The formula for calculating the operating cash flow ratio is as.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. We can apply the values to our variables and calculate Cash Flow to Sales.

Maka cash yang di miliki perusahaan pada akhir periode. Cash flow from operating ini adalah uang masuk dan keluar dari aktivitas operasional suatu perusahaan. Cash Flow-to-Debt Ratio.

Operating cash flow ratio adalah Thursday July 7 2022 Edit. OCR Ratio Cash flow from operating activities Current liabilities. Dalam artikel ini Rivan Kurniawan akan membahas.

The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is. The operating cash flow ratio is a.

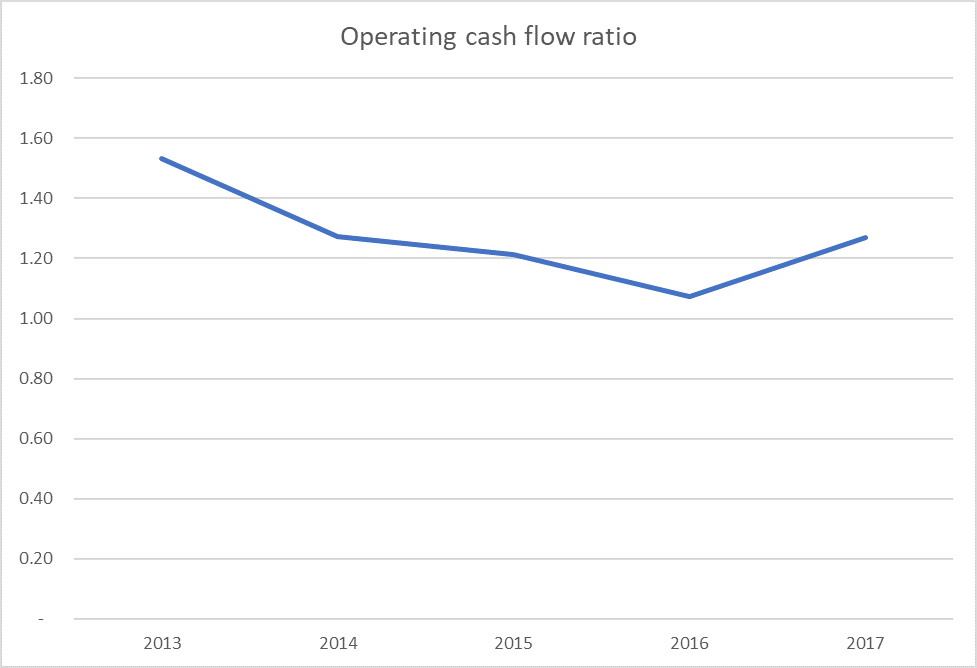

Now lets use our formula. The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. Terlihat pada ringkasan laporan keuangan GJTL 2017 dan PPRO 2017 diatas nilai Operating Cash Flow berada pada akun nomor 16 sedangkan Current Liabilities berada pada.

The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Operating Cash Flow. Arus kas dari operasi atau Cash flow from operating activities merupakan bagian dari arus kas perusahaan yang mewakili.

Pengertian Cash Ratio. Terakhir untuk menghitung net cash flow perusahaan ABC Anda harus menjumlahkan ketiga subtotal sebagai berikut. Operating Cash Flow Margin.

Cash ratio atau dalam bahasa Indonesianya adalah rasio kas adalah rasio yang bisa digunakan untuk menilai perbangan antara total kas dan setara kas. 80000000 15000000 40000000. Bagaimana Cara Menghitung Rasio Arus Kas.

Price To Cash Flow P Cf Ratio Definition Formula And Example

Free Cash Flow To Operating Cash Flow Ratio Accounting Play

Cash Flow Ratios Calculator Double Entry Bookkeeping

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Definition Formula And Examples

What Does A Negative Operating Cash Flow Mean Cliffcore

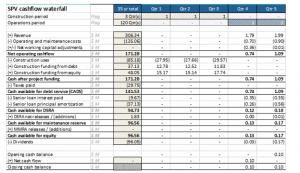

Project Finance Cash Flow Waterfall

Pdf The Role Of The Isa 570 Adverse Key Financial Ratios In Going Concern Assessment In Italy Semantic Scholar

Cash Eps Operating Cash Flow Divided By Shares Outstanding

What Is Negative Cash Flow 5 Tips To Manage It Article

Operating Cash Flow Ratio Definition Formula Example

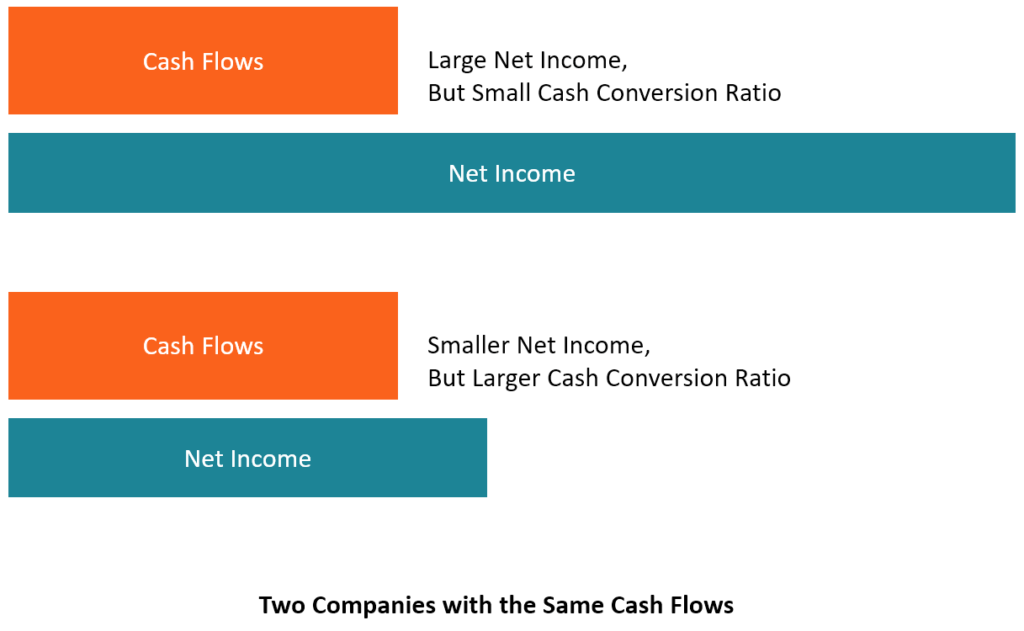

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Chapter 11 Statement Of Cash Flows Ppt Download

Cash Flow Statement Examples And Analysis

What Does The Cumulative Cash Flow Mean Quora

:max_bytes(150000):strip_icc()/Term-Definitions_freecashflow_FINAL-ebecf2a8576047c0a8b9446f29b63b71.png)